Finding the best auto insurance policy can feel overwhelming. With so many coverage options, providers, and pricing plans available, many drivers struggle to understand which one truly fits their needs. Learning how to choose car insurance wisely can help you save money, ensure protection, and avoid costly surprises later. The key is to balance your coverage needs with your budget while understanding how each factor affects your premiums.

In this detailed guide, we’ll walk you through the essential steps to find the perfect policy, compare providers, and make informed choices. Whether you’re a new driver or looking to switch insurers, these tips will help you navigate the car insurance comparison process with confidence.

1. Understand the Basics of Car Insurance

Before you can choose car insurance that fits your budget, it’s crucial to understand what an auto insurance policy actually covers. Most policies are made up of several key components, each serving a different purpose:

- Liability coverage: Covers damages or injuries you cause to others in an accident.

- Collision coverage: Pays for damage to your car after an accident, regardless of who’s at fault.

- Comprehensive coverage: Protects against non-collision events like theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): Helps pay for medical expenses after an accident.

- Uninsured/Underinsured Motorist coverage: Protects you if the other driver doesn’t have enough insurance.

Understanding these options helps you avoid overpaying for unnecessary add-ons while ensuring adequate protection. You can learn more about policy types from the Insurance Information Institute.

Pro Tip: Many states require only liability coverage, but that may not be enough if your car is new or financed. Comprehensive protection is often worth the extra cost.

2. Evaluate Your Personal and Financial Needs

When deciding on an auto insurance policy, think about your unique situation. Your driving habits, the value of your car, and your financial stability all play a major role in determining your coverage needs.

If you drive frequently or live in an area with high traffic or theft rates, consider higher coverage limits. On the other hand, if you have an older car, dropping collision or comprehensive coverage might make financial sense. According to Consumer Reports, you can save hundreds per year by adjusting your coverage to match your vehicle’s current value.

Suggestion In Our Site : Check our article Best High-Yield Savings Accounts in 2025 to learn how to build an emergency fund that can cover your deductible easily.

Pro Tip: A good rule of thumb — if your car’s value is less than 10 times the annual premium for full coverage, consider basic liability coverage only.

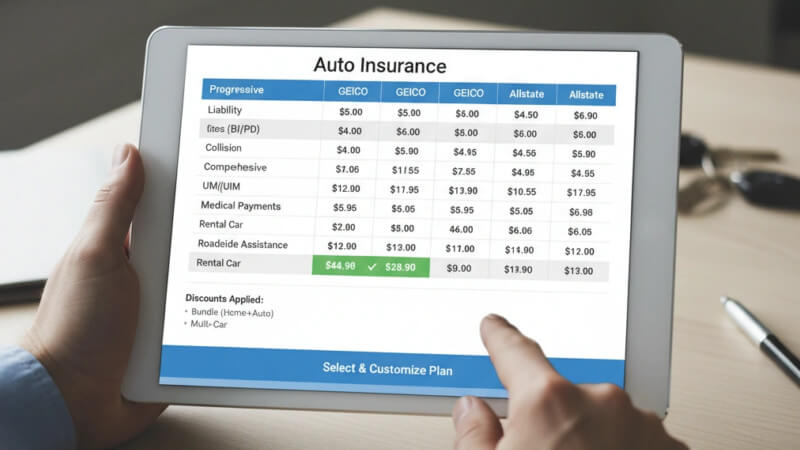

3. Compare Insurance Quotes from Multiple Providers

One of the smartest ways to save money is by conducting a thorough car insurance comparison. Rates can vary significantly from one provider to another — sometimes by hundreds of dollars for the same coverage. Take advantage of online comparison tools like The Zebra, Compare.com, or Policygenius to review multiple quotes at once.

While price is important, don’t just choose the cheapest policy. Look at customer service ratings, claim response times, and satisfaction scores from sources like J.D. Power or NerdWallet.

Pro Tip: Check for hidden fees and verify that the quote includes all the coverage types you need. Some “cheap” plans exclude essential protections.

4. Balance Deductibles and Premiums

Your deductible — the amount you pay out of pocket before insurance kicks in — directly affects your premium cost. A higher deductible typically means a lower monthly premium, while a lower deductible raises your monthly rate but reduces your upfront cost in case of an accident.

To choose car insurance that fits your budget, find the right balance. If you have savings set aside for emergencies, a higher deductible might save you money over time. However, if paying a large amount upfront would be difficult, a lower deductible offers peace of mind.

For more on finding the right balance, visit Bankrate’s Car Insurance Deductible Guide.

Pro Tip: Adjusting your deductible from $500 to $1,000 can save up to 15% on premiums — but only if you can afford that amount after an accident.

5. Look for Discounts and Bundling Options

Insurance companies offer a variety of discounts that can help you reduce your costs without sacrificing coverage. Common examples include:

- Safe driver discounts for accident-free records.

- Good student discounts for young drivers with high grades.

- Multi-policy discounts for bundling home, renters, or life insurance.

- Vehicle safety discounts for cars with anti-theft systems or advanced safety features.

Visit your provider’s discount page or use ValuePenguin to identify discounts available in your area. Bundling multiple policies under one insurer, like State Farm or GEICO, can also save up to 25%.

Pro Tip: Always ask your insurer if you qualify for loyalty, low-mileage, or online payment discounts — many of these aren’t advertised widely.

6. Check the Company’s Reputation and Financial Strength

Before you commit to an auto insurance policy, research the company’s reliability. The best insurers offer fast claims processing, excellent customer support, and transparent communication. You can check financial strength ratings through A.M. Best or customer reviews on BBB.org.

A strong insurer ensures that your claims will be paid on time, even during large-scale events like storms or natural disasters. Companies with top ratings also tend to have better customer retention and service quality.

Pro Tip: Choose established insurers with a proven track record rather than unknown companies that offer unrealistically low rates.

7. Reassess Your Policy Annually

Your insurance needs can change as your car ages, your finances shift, or your lifestyle evolves. It’s a good idea to review and compare your auto insurance policy every year. Many drivers overpay simply because they never reassess their coverage.

For instance, if your car’s market value has decreased, you may not need full comprehensive coverage anymore. Alternatively, if you’ve improved your credit score or driving history, you might qualify for lower premiums.

Use websites like Insure.com or Progressive to check current offers. You can also use your existing insurer’s loyalty discounts to negotiate better rates.

Suggestion In Our site : To make smarter financial decisions overall, explore our article Why Tiny Homes Are Becoming Big Business in 2025 — a great read on saving and investing in sustainable living.

Pro Tip: Set a calendar reminder to compare your rates every 12 months — it’s an easy way to ensure you’re not overpaying.

8. Avoid Common Mistakes When Choosing a Policy

When learning how to choose car insurance, many people make the same costly mistakes. Avoiding these can save you time and money:

- Underinsuring your vehicle just to get a cheaper premium.

- Skipping uninsured motorist coverage, which can be disastrous after an accident.

- Not comparing quotes from different providers regularly.

- Ignoring fine print on coverage exclusions or cancellation policies.

Educate yourself using reliable sources like Forbes Advisor’s Car Insurance Guide to ensure you understand all terms and avoid surprises later.

Pro Tip: A cheap plan isn’t always the best plan — focus on value and reliability instead of price alone.

Final Thoughts: Smart Choices Lead to Big Savings

Learning how to choose car insurance that fits your budget doesn’t have to be complicated. Start by understanding your coverage needs, comparing multiple providers, and looking for available discounts. Always focus on getting the most value rather than just the lowest price.

The right auto insurance policy offers financial protection, peace of mind, and flexibility. With careful research, you can make informed decisions that safeguard both your car and your wallet — today and in the future.

By following these steps, you’ll not only save money but also ensure that your coverage truly works for your lifestyle. Take the time to reassess, compare, and customize — your perfect policy is just a few clicks away.