Your credit score plays a major role in your financial life. Whether you’re applying for a loan, credit card, mortgage, or even renting an apartment, lenders use your score to determine how trustworthy you are. The higher your score, the more financial opportunities you’ll unlock — including lower interest rates, higher credit limits, and better loan terms. In this guide, we’ll explore powerful strategies to boost credit score, improve financial health, and qualify for better rates.

Before going deeper, if you want more practical financial guides, check out this resource:

Smart Money Advice (dmyay.com)

Why Your Credit Score Matters

Your credit score affects nearly every major financial decision. A small improvement, even by 20–40 points, can save you thousands of dollars over your lifetime. According to Experian, those with “excellent” credit enjoy the best loan rates, while those with “poor” credit often pay double or triple in interest costs.

How Credit Scores Impact Borrowing Costs

When you apply for loans—such as auto loans, mortgages, or credit cards—lenders evaluate your credit score to determine risk. A higher score means you are seen as low risk and therefore receive lower interest rates. A lower score leads to higher rates and fewer approvals.

For example, Bankrate shows that someone with a 760+ credit score might receive a 2.9% auto loan rate, while someone with a 580 score may pay over 12%. That difference can add up to thousands of dollars.

1. Pay Bills on Time — The Most Important Factor

Your payment history makes up 35% of your credit score—the single biggest factor. Every late payment can stay on your credit report for up to seven years, according to MyFICO.

How to Avoid Late Payments

- Set automatic payments for recurring bills

- Use reminders or calendar alerts

- Consolidate bills to reduce confusion

If you’ve missed payments in the past, don’t panic. The more on-time payments you make going forward, the faster your score will recover.

2. Lower Your Credit Utilization Ratio

Your credit utilization ratio is the percentage of your available credit that you are using. Financial experts at NerdWallet recommend keeping this number below 30%, and the lower, the better.

How to Quickly Reduce Utilization

- Pay down revolving balances

- Ask creditors for a credit limit increase

- Spread spending across multiple cards

Even a small decrease in credit usage can boost your score within weeks.

3. Dispute Errors on Your Credit Report

According to the Federal Trade Commission (FTC), 1 in 5 consumers have errors on their credit reports that negatively affect their scores.

How to Check Your Credit Report for Free

You are entitled to a free annual credit report from:

- AnnualCreditReport.com

- The three major bureaus: Equifax, TransUnion, Experian

Disputing and removing errors—such as incorrect balances or outdated accounts—can quickly improve credit score.

4. Build Credit with a Secured Credit Card or Credit Builder Loan

If you have no credit or bad credit, secured credit cards are one of the easiest ways to rebuild. Many banks offer them, including Capital One and Discover.

Why These Tools Work

Unlike traditional credit cards, secured cards require a deposit. This deposit acts as your credit limit, making them low-risk for lenders and easy to qualify for. Use the card responsibly, and your score will rise within months.

You can also look into credit-builder loans from institutions such as Self, which help you build credit while saving money.

5. Maintain a Long Credit History

Length of credit history makes up 15% of your score. Keeping your oldest accounts open helps build trust and improves your average credit age.

Tips to Improve Credit Age

- Keep old accounts open, even if unused

- Use older accounts occasionally to keep them active

- Avoid opening too many new accounts

According to Investopedia, closing an old credit card can lower your score significantly by reducing your average account age and raising your utilization ratio.

6. Limit Hard Inquiries

Every time you apply for credit, a hard inquiry is added to your report. Too many inquiries can hurt your score.

How to Avoid Unnecessary Inquiries

- Compare rates using “soft check” tools

- Only apply for credit when necessary

- Apply for loans within a short window (rate shopping protection)

The experts at Credit Karma suggest spacing out applications by at least six months to minimize impact.

7. Consider Debt Consolidation if You’re Struggling

If you feel overwhelmed by multiple debts, consolidation can help reduce interest rates and simplify payments. Sites like LendingTree and SoFi provide comparison tools to help you find better loan terms.

How Consolidation Improves Your Score

- Reduces credit utilization

- Reduces late payments

- Lowers overall loan burden long-term

Just ensure you don’t start accumulating new debt after consolidating.

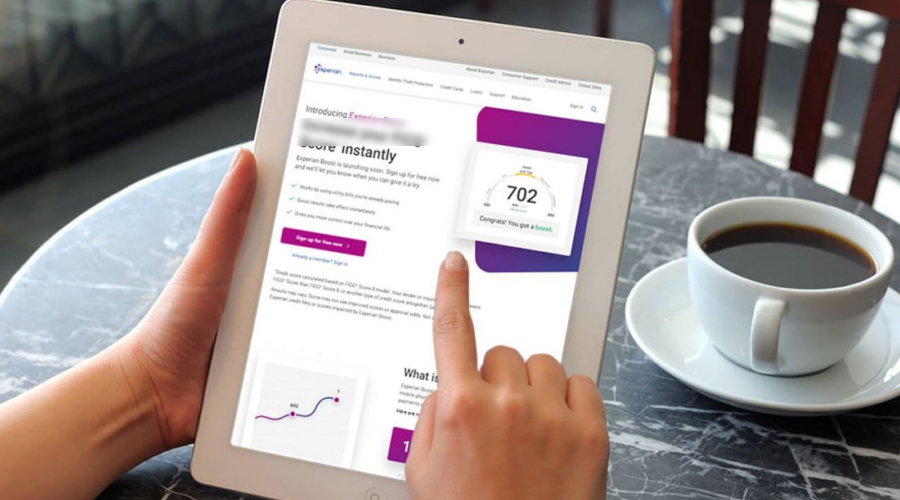

8. Add Utility and Rent Payments to Your Credit Report

Many people pay rent and utilities on time every month, but these payments normally don’t count toward credit history. Tools like Experian Boost allow you to add these payments to your score quickly.

Some landlords also report rent through services like RentReporters.

9. Monitor Your Credit Regularly

Staying updated on your credit standing helps prevent fraud, errors, and sudden score drops. You can track your score using:

This also helps you understand how financial decisions impact your score.

Final Thoughts: Achieving a Strong Credit Score

Improving your credit score is not an overnight process, but it is absolutely achievable with consistency. By paying bills on time, lowering utilization, disputing errors, and being strategic about new credit, you can build a powerful credit profile that unlocks better loan rates and long-term financial stability.

For more financial advice, visit:

Financial Tips & Guides (dmyay.com)